Maryland Families Rely on Delivery

Preserving an affordable and convenient delivery economy is critical in supporting Maryland families, small businesses and workers.

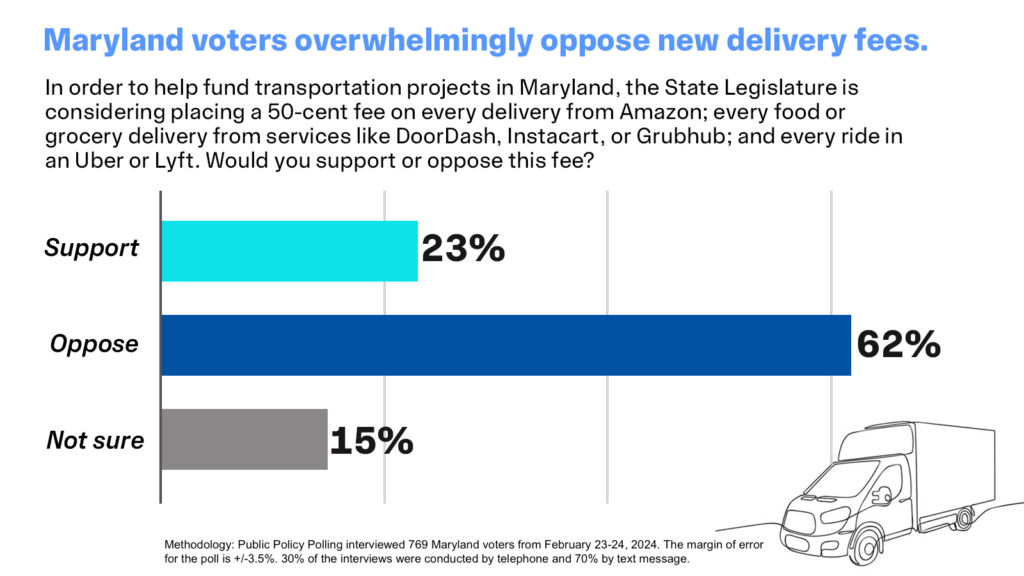

Rather than help families in Maryland, HB 1215 would impose a tax on most retail deliveries in the state, including groceries, takeout, and e-commerce deliveries.

HB 1215 Hurts Families & Workers in Maryland

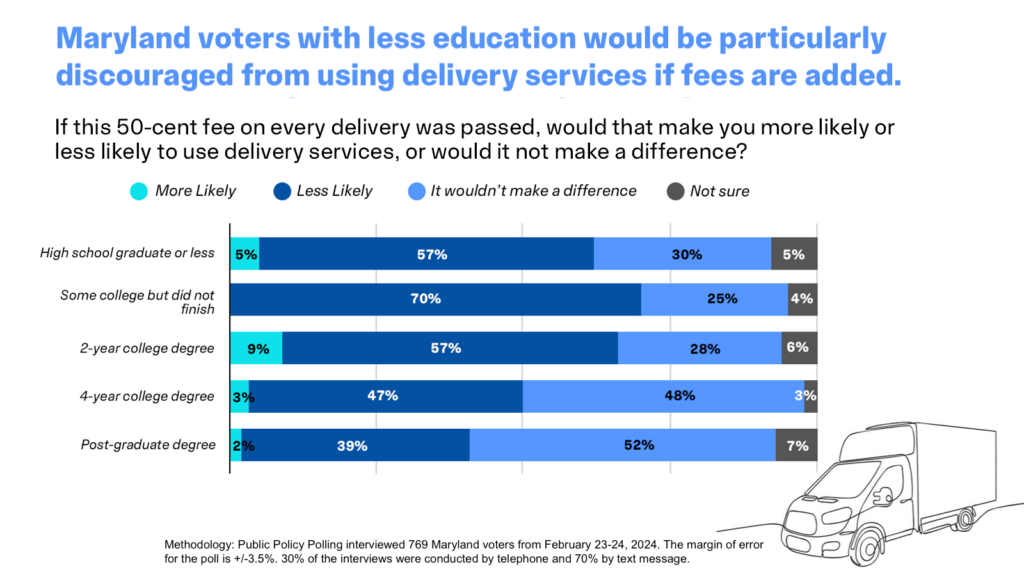

Taxes on retail deliveries are regressive.

Delivery taxes would put an unacceptable strain on the budgets of the nearly 1 in 4 Baltimore residents living in a food desert, elderly and disabled communities who rely on delivery services for basic necessities, and low-income families, who are hit hardest by rising prices for food.

Taxes on deliveries incentivize more trips to the stores, putting more cars on the road and more pollutants in the air.

Increasing the cost of delivery would push people to make their own trips to stores and restaurants, increasing emissions and congestion. Delivery services are more efficient, with optimized routes and a single vehicle making deliveries to multiple households.

Taxes on deliveries hurt small businesses.

Increasing prices for consumers and compliance costs for businesses will make it even harder for small businesses to grow and compete. In Colorado where doorstep taxes are in place, small businesses have reported spiking compliance and accounting costs at a time when they can least afford it.

Taxes on deliveries would harm the most vulnerable members of this state, especially low-income families, elderly and disabled communities, and residents of food deserts who depend on delivery services for access to fresh groceries. An economic analysis we conducted also found that these taxes would hurt small businesses and increase single-occupancy-vehicle emissions and traffic congestion.

What People in Maryland are Saying

"This fee would disproportionately burden the most vulnerable members of the state, from residents of food deserts, individuals with disabilities, and low-income families who depend on the convenience of delivery services."

Chamber of Progress

DMV Black Restaurant Week

Greater Washington Hispanic Chamber of Commerce

National Alliance on Mental Illness Maryland

National Federation of the Blind of Maryland

People On the Go Maryland

"The result of HB 1215, if implemented, would mean higher costs to restaurants, retail establishments and, in the end, consumers...Layering on additional impact fees will mean restaurants will have to set higher menu prices on delivery items to cover the cost of doing business."

Annapolis Mayor Gavin Buckley

"Outside of the impact on the business community here in Prince George's and across the state, we see this as a regressive tax that will deeply affect working families, increasingly shrinking their bottom lines...While we understand the need for transportation funding in the state, we do not believe the burden should be transferred to Maryland's working families."

Greater Prince George's Business Roundtable

"While we agree that the TTF is in need of sustainable funding sources, we believe that it is too early to decide what those funding sources should be...There is also concern over imposing taxes on deliveries, as they could harm the most vulnerable Marylanders, including low-income families, elderly and disabled communities, and residents of food deserts who depend on delivery services for access to groceries, medication and more."

Maryland Chamber of Commerce

"This proposal is poor public policy that puts our small businesses in a difficult position of explaining why customers must pay more for delivery that uses the same roads that customers would travel if they were able to dine in or pick up their food. In this case, the rationale for the bill makes no sense."

Restaurant Association of Maryland

"Apart from negatively affecting the business community in Prince George's County and across the state, we believe this is a regressive tax that would disproportionately impact lower-income families in our county."

The Prince George's County Council

"Many of our members feel as though Maryland is already a difficult and expensive place to do business and for employees to live, especially compared to surrounding states. If passed, this delivery fee will be perceived by the business community as another competitive disadvantage, as surrounding states do not impose such a fee."

Maryland Tech Council

"Alcoholic beverage deliveries by licensed retailers fall within the scope of this bill...Given that two separate taxes specific to alcohol are already applied to its retail sale, MSLBA does not believe that further taxes on alcoholic beverages are appropriate."

Maryland State Licensed Beverage Association

"This is an awful idea. As a matter of policy, a new tax is unnecessary. In Maryland, we already have an income tax, a gas tax, a sales tax and a property tax. We even have a rain tax. We don’t need any new taxes. As a matter of politics, Korman’s proposal isn’t just a bad idea, it’s crazy. It will undoubtedly prove very unpopular with voters and it will feed the divisive narrative that the only thing Democrats are interested in is raising taxes."

Patrick Purcell, Odenton

Lessons Learned from Colorado and Minnesota

Colorado and Minnesota are the only states that have adopted taxes on deliveries. In both states, small businesses, consumer advocates, and voters spoke out against the added strain on their budgets.

Delivery taxes hurt small businesses:

Group says new retail delivery fee will pose ‘a significant burden’ on Colorado business operations – The Center Square (6/28/22)

“Some small business owners are sounding o against a new fee that’s set to take effect on retail items that customers purchase and have delivered…More than 500 small businesses and individuals expressed concerns about the new fee during a rulemaking hearing…”

Confusion swirls as Colorado imposes new retail delivery fee, catching businesses by surprise – The Denver Gazette (7/9/22)

“The new fee is occurring at a time of record-setting inflation, spiking home prices, and a general sense of how unaordable living in Colorado has become, particularly in metro Denver. It’s also occurring even as elected officials promise to do everything in their power to lift the economic burden on residents.”

Our View: C’mon Minnesota, a tax on pizza deliveries? – Duluth News Tribune (5/20/2023)

“(The) fee…promises to be especially burdensome on elderly, handicapped, and lower-income Minnesotans who rely on deliveries because it’s harder for them to get out.”

Letter from the Minnesota Retailers Association Opposing Delivery Tax (3/22/2023)

“[The] bill does not account for the intricacies required for a retailer to build a system to track, collect and remit the fees. […] Retailers will need to substantially invest in resources to comply with the fee, yet there is no support for that administration.”

Delivery taxes hurt struggling families:

-

“The tax increase will certainly touch every Minnesotan, but for vulnerable and low-income communities, the tax hike will scrap carefully balanced budgets. As many consumers are already struggling to make ends meet, this tax will only further push them behind.”

-

Unnecessary delivery tax causes more than good to Minnesotans – MinnPost (4/20/2023)

“Busy families, elderly, and the disabled rely on delivery services daily to maintain their livelihoods and access essential everyday items. They depend on food, household items and personal care items to be delivered to their homes, and this proposed tax would only add another burden.”

-

Protests at the capitol Friday against proposed 75 cent delivery fee – Wilmar Radio (5/20/2023)

“Minnesota Retailers Association’s Bruse Nustad […] says it’s a “pretty regressive” tax especially on the elderly and people with disabilities who rely on delivery.”

What People Are Saying

"This fee is regressive, impacting our guests and delivery employees. While 75 cents might not seem like a lot, it is significant."

J.J. Haywood, CEO of Pizza Luce (Minneapolis, MN) - MinnPost, 3/27/23

"I'm here to give a service and when we're adding more and more to the small business owners' plates, it's so much harder to do that…I continue to have to pay for more accounting services and administration just to make sure my taxes are being paid right now."

Mari Harries, Owner of River City Eatery (Windom, MN) - CBS News Minnesota, 5/5/23

"A very large percentage of my customers will be affected by this. I’m sure once they end up on the website and they see an additional fee, I will be getting phone calls on that…There’s so many hats involved in being a business owner, it’s really hard to kind of start to have to educate my customers now that we have this whole new fee and it’s just a whole extra thing. And it’s very time consuming."

Sheri Cervantes, Owner of A Flower Girl’s Dream (Colorado Springs, CO) - CBS News Colorado Springs, 7/7/22

“This proposed delivery fee mandated on nearly every Minnesota consumer undoes any progress made post pandemic, and will negatively impact everyone involved. As the state looks for thoughtful solutions to solve transportation challenges, the proposed fee will enable more harm than good.”

Hollies Winston, Mayor (Brooklyn Park, MN) - MinnPost, 4/20/23

“New Yorkers rely on delivery services on a daily basis…A regressive tax like this will do more harm than good. This cannot be allowed to gain a foothold. 25 cents may seem insignificant but Albany has a habit of using new taxes such as this as a starting point, not a finish line.”

Linda Rosenthal, Assembly Member (67th District, NY) - Pluribus, 4/3/23

“Consumers and businesses don’t need an entirely new, complicated taxing system when we already have several existing mechanisms in place to raise funds for transportation…Calling the tax a ‘road improvement fee’ won’t fool Minnesotans.”

Bruce Nustad, Minnesota Retail Association President - MinnPost, 5/20/23

“Removing the delivery fee certainly leads me to enthusiastically support your bill. Before that there was some hesitancy. I might add, with those particular removals from the bill, I am enthusiastically a supporter.”

Ann Rest, State Senator (43th District, MN) - Alpha News, 4/14/23

“For a growing number of Americans, deliveries are not a luxury – they are a necessity. Working parents, the disabled community, seniors and those living in food deserts all depend on accessible delivery services”

Adam Kovacevich, Chamber of Progress CEO - Statement, 5/3/23

Get Updates

Get updates on the latest news about doorstep delivery taxes right to your inbox.