Delivery Without Extra Taxes

In 2022, Colorado residents started paying a new 27 cent “doorstep” tax on every restaurant, grocery and e-commerce purchase delivered directly to their homes. Despite growing backlash from consumers and businesses in Colorado, other states – including Illinois and Rhode Island – are considering imposing similar harmful doorstep taxes.de

A Delivery Tax Hurts Families & Workers

American families rely on delivery

Doorstep delivery is a critical, often overlooked part of everyday life in America. Families working long hours, elderly people, the disability community and those living in rural and remote localities depend on affordable and accessible delivery services for prescriptions and other essentials.

Delivery taxes result in DOUBLE taxation on consumers

In Colorado, where doorstep taxes are in place, some localities have imposed their sales tax on top of the new doorstep tax, resulting in double taxation for consumers.

Delivery powers small business growth and jobs

Doorstep delivery of food, groceries and packages supports millions of jobs in the U.S and helps to expand the customer base for businesses. Conversely, in Colorado where doorstep taxes are in place, small businesses have reported spiking compliance and accounting costs at a time when they can least afford it.

Extra taxes means fewer deliveries & reduced wages for workers

Delivery jobs employ a wide spectrum of Americans. Gig workers and delivery drivers earn less when consumers choose fewer deliveries.

Taxing deliveries adversely impacts the climate

Driving to and from the store produces more greenhouse gas emissions than delivery. Delivery taxes incentivize customers to shop with personal vehicles, increasing emissions.

How Have Voters Been Hurt by Delivery Taxes?

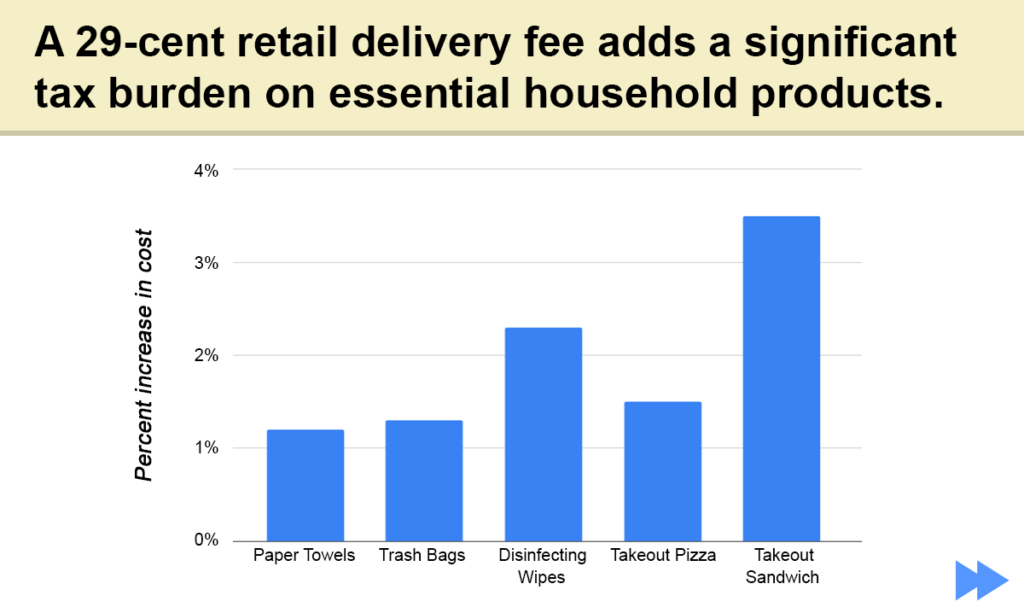

Analyzing data out of Colorado to examine the economic impact of delivery taxes, NDP Analytics discovered new fees hit low-income families and Colorado restaurants the hardest. For basic goods like paper towels or a takeout order, delivery taxes can amount to a 1 to 4% sales tax.

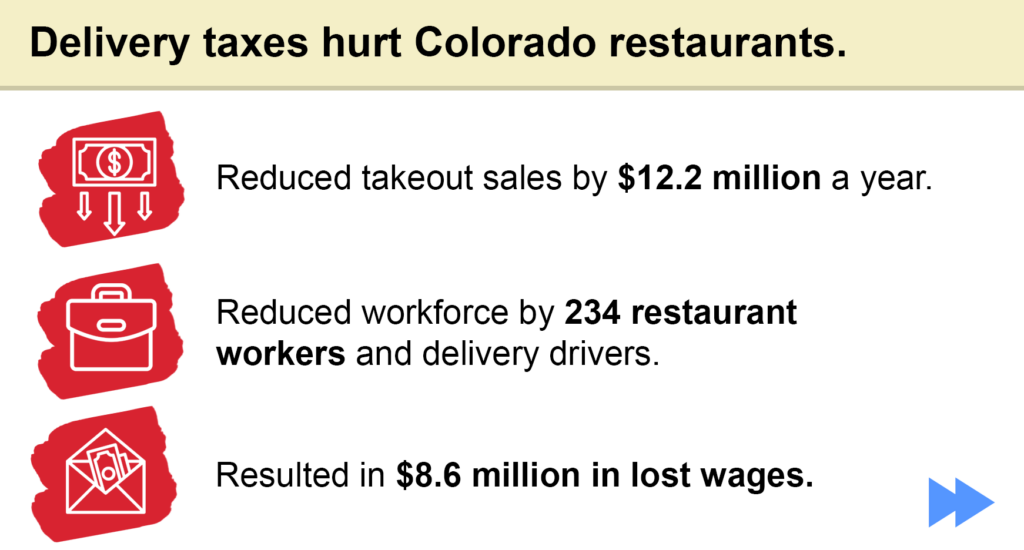

Colorado businesses and residents also suffer as increases in the cost of online orders lead to fewer purchases – resulting in lost sales for businesses, lost workers, and lost wages.

For more analysis of delivery taxes’ impact on local businesses in Colorado, their budgetary impact, and their impact on jobs and wages, read the full report.

Who is Impacted by Delivery Taxes?

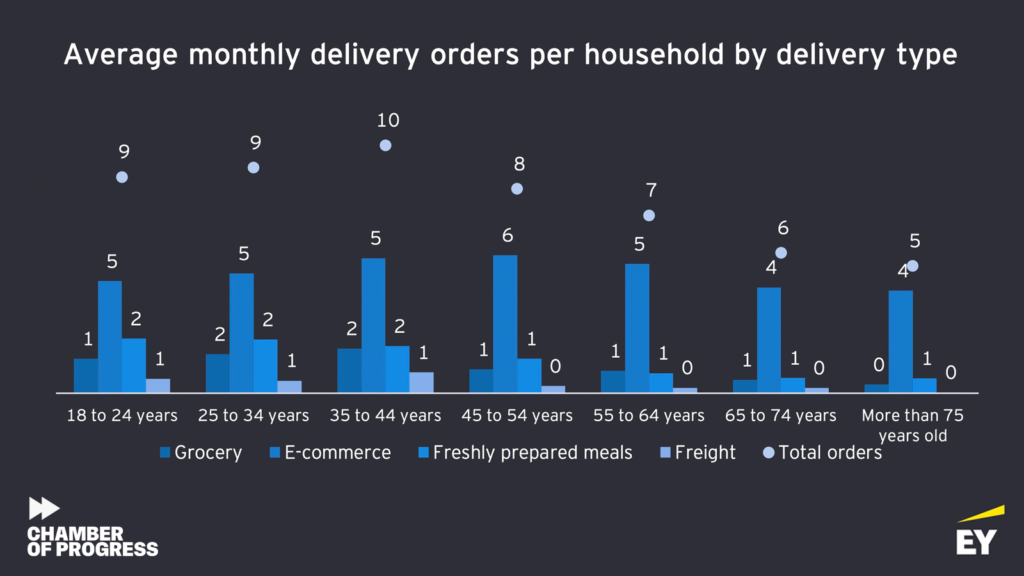

With 10 deliveries per month, households aged 35-44 had the highest average number of monthly deliverables. This means younger Americans are bearing the brunt of the burden caused by additional fees

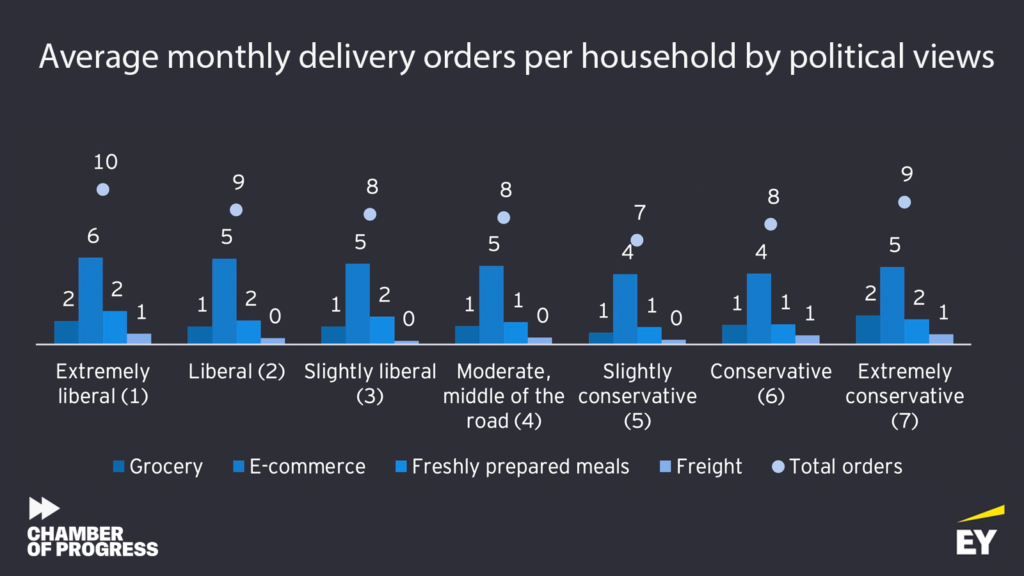

However, the distribution of delivery orders was not significantly different across political views. Liberals and conservatives are just as likely to rely on delivery–and be forced to pay delivery fees.

For many households, delivery is a necessity and not a luxury, with 20% reporting that they relied on delivery due to a disability or other mobility issue because they did not have help from family members or other sources.

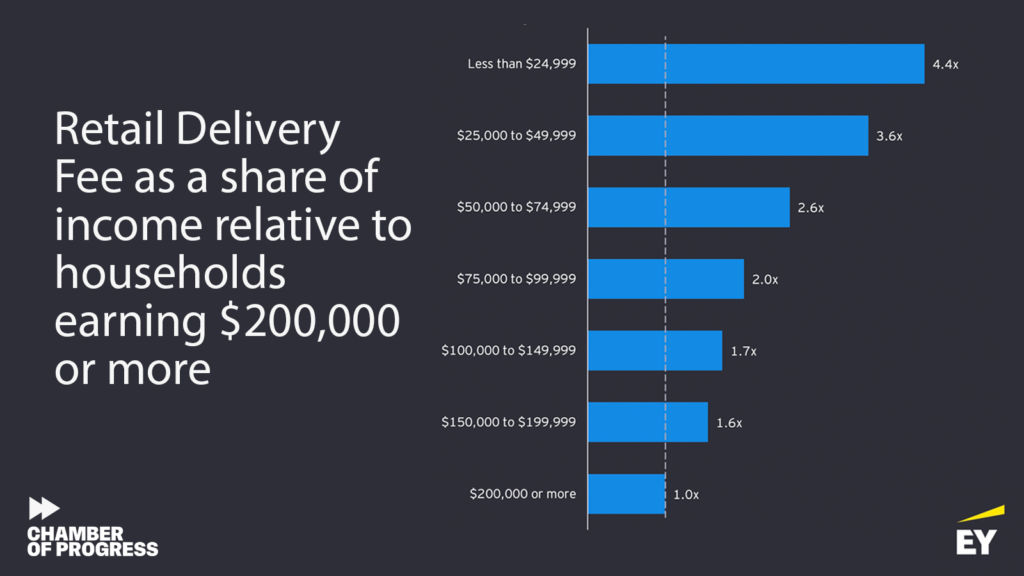

Delivery fees also account for a higher share of household income for lower income households vs. higher income ones, confirming the regressive nature of delivery fees

Read the full report for more details on how delivery fees impact the already burdened.

How Do Online Deliveries Reduce Emissions?

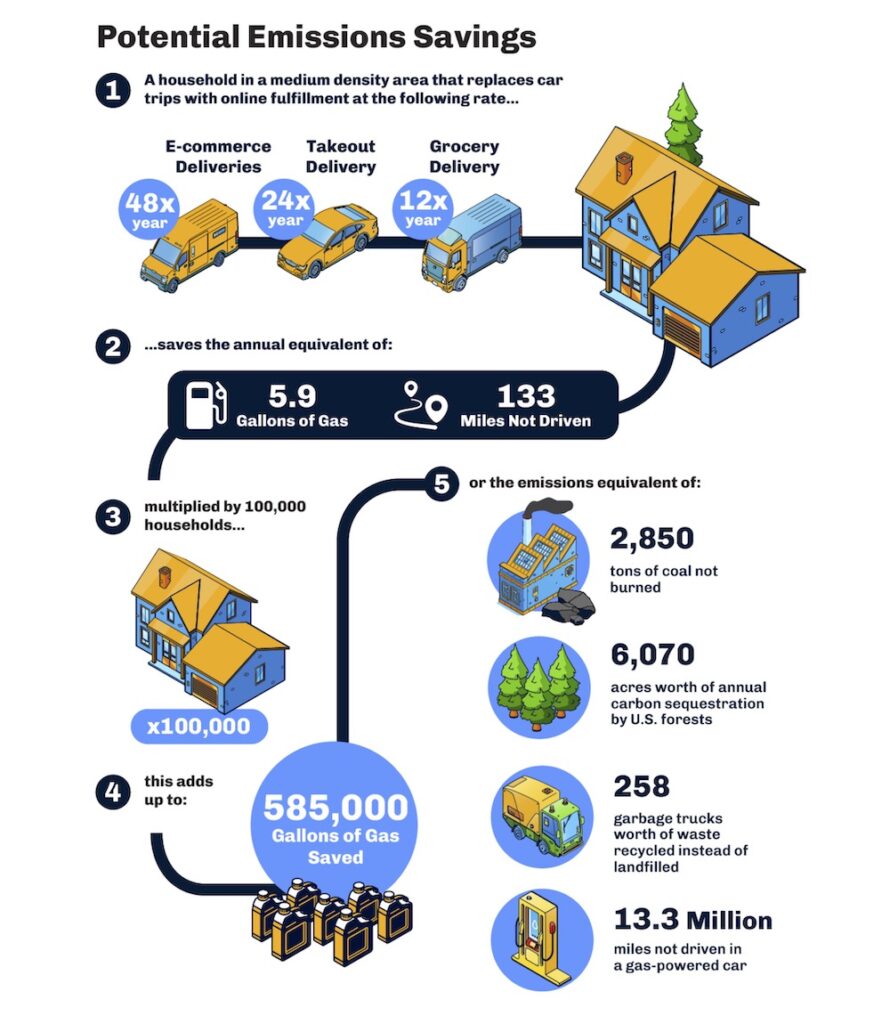

In a report examining the emissions impact of online delivery, Chamber of Progress found that delivery orders reduce both carbon emissions and roadway usage over individual trips to the store. The report examines the increased efficiencies of delivery in urban vs rural areas, compares e-commerce to batched grocery and instant takeout delivery, and breaks down gallons of gas saved by delivery by state.

Findings from the report on online delivery and emissions include:

- E-Commerce deliveries are able to capitalize on operational efficiencies like batching and smart routing. These deliveries are 2.3x to 2.7x more efficient than individual consumer trips. E-Commerce can save up to 1,416 miles of travel and 62 gallons of gas per 1,000 items delivered.

- Batched grocery deliveries are 1.1x to 1.5x more efficient than individual consumer trips and can save up to 300 miles of travel and 13 gallons of gas per 1,000 items.

- A household that replaces car trips with online fulfillment could experience annual savings of up to 5.9 gallons of gas saved and 133 fewer miles driven per household.

- If half of U.S. households experienced these reductions, the potential annual emissions savings for last mile online delivery are equivalent to a day’s worth of gasoline usage for the U.S. as a whole.

Read the full report for more details on how delivery fees would result in negative environmental impacts.

What People Are Saying

"Consumers who order delivery out of convenience may opt to pick up their orders to avoid the doorstep tax, while those who have no practical alternative will be unable to escape the levy. This may make the tax regressive overall."

Andrew Leahey - Bloomberg News, 2/9/25

"Online delivery taxes would disproportionately impact vulnerable populations, add more cars on roadways, increase emissions, and strain local businesses."

Adam Kovacevich, Chamber of Progress CEO - The Spokesman-Review, 8/19/24

"This fee is regressive, impacting our guests and delivery employees. While 75 cents might not seem like a lot, it is significant."

J.J. Haywood, CEO of Pizza Luce (Minneapolis, MN) - MinnPost, 3/27/23

"I'm here to give a service and when we're adding more and more to the small business owners' plates, it's so much harder to do that…I continue to have to pay for more accounting services and administration just to make sure my taxes are being paid right now."

Mari Harries, Owner of River City Eatery (Windom, MN) - CBS News Minnesota, 5/5/23

"A very large percentage of my customers will be affected by this. I’m sure once they end up on the website and they see an additional fee, I will be getting phone calls on that…There’s so many hats involved in being a business owner, it’s really hard to kind of start to have to educate my customers now that we have this whole new fee and it’s just a whole extra thing. And it’s very time consuming."

Sheri Cervantes, Owner of A Flower Girl’s Dream (Colorado Springs, CO) - CBS News Colorado Springs, 7/7/22

“This proposed delivery fee mandated on nearly every Minnesota consumer undoes any progress made post pandemic, and will negatively impact everyone involved. As the state looks for thoughtful solutions to solve transportation challenges, the proposed fee will enable more harm than good.”

Hollies Winston, Mayor (Brooklyn Park, MN) - MinnPost, 4/20/23

“New Yorkers rely on delivery services on a daily basis…A regressive tax like this will do more harm than good. This cannot be allowed to gain a foothold. 25 cents may seem insignificant but Albany has a habit of using new taxes such as this as a starting point, not a finish line.”

Linda Rosenthal, Assembly Member (67th District, NY) - Pluribus, 4/3/23

“Consumers and businesses don’t need an entirely new, complicated taxing system when we already have several existing mechanisms in place to raise funds for transportation…Calling the tax a ‘road improvement fee’ won’t fool Minnesotans.”

Bruce Nustad, Minnesota Retail Association President - MinnPost, 5/20/23

“Removing the delivery fee certainly leads me to enthusiastically support your bill. Before that there was some hesitancy. I might add, with those particular removals from the bill, I am enthusiastically a supporter.”

Ann Rest, State Senator (43th District, MN) - Alpha News, 4/14/23

Get Updates

Get updates on the latest news about doorstep delivery taxes right to your inbox.

Delivery Tax News

Legislatures & Communities Across the U.S. Oppose Regressive Delivery Taxes

Colorado Delivery Tax: Top Issue for Voters

Protests at the capitol Friday against proposed 75 cent delivery fee

KWLM – St. Paul, MN

Unnecessary delivery tax causes more harm than good to Minnesotans

MinnPost

Businesses raise alarm about 75-cent retail delivery fee proposal at Minnesota Legislature

CBS News Minnesota

Minnesota Opinion: C’mon Minnesota, a tax on pizza deliveries?

West Central Tribune

Minnesota’s new delivery fee riles retailers

MPR News

‘Delivery Fees’ Are the Newest Way for States to Raise Your Taxes

Real Clear Markets

Unnecessary delivery tax causes more harm than good to Minnesotans

MinnPost

State Delivery Taxes Could Bring More Traffic, More Stress, and Fewer Orders for Local Restaurants

Chamber of Progress

Letter: Minnesota Retailers to Legislators Opposing Delivery Tax

Minnesota Retailers Association

Confusion swirls as Colorado imposes new retail delivery fee, catching businesses by surprise

The Denver Gazette

Confusion, frustration over Colorado’s 27 cent retail delivery fee

KUSA – Denver, CO

Colorado Senate president willing to nix frustrating provision of retail delivery fee

Denver Business Journal

Colorado’s new retail delivery fee takes effect, drawing criticism

The Gazette

Taxing a fee: Some Colorado cities profit from controversial state delivery fee

The Denver Gazette

Group says new retail delivery fee will pose ‘a significant burden’ on Colorado business operations

The Center Square

New Colorado retail delivery fee causing issues for small businesses

KKTV – Colorado Springs, CO

Infrastructure Funding

Alternatives to Doorstep Taxes

Colorado is a clear outlier. No other state is seriously considering imposing delivery taxes. Below are just a few examples of how other states’ are addressing declining gas tax revenues.

Virginia’s Mileage Choice Program

"More than 7,000 Virginians have signed up to pay a fee for each mile they drive under a program launched this summer, putting the state at the forefront of a nationwide effort using new technology to prop up gas taxes that pay for roads.”

Utah’s Road Usage Charge Program

"The road usage charge program, a voluntary pilot program that started in January 2020, allows users to pay based on miles driven using a device in their car. Users are given the option to pay 1.5 cents per mile traveled or an annual flat fee of $120 for electric vehicles or $20 for gas hybrids. Per-mile payment stops when the accumulated total for the year reaches the flat fee, so customers can pay less if they drive less.”

Oregon’s Road Usage Charge Program (OReGO)

"OReGO is a voluntary road-usage fee program that allows drivers to pay 1.8 cents per mile traveled. The project could also serve as a mechanism for collecting highway funding from electric vehicle drivers.”

Massachusetts’ Fair Share Amendment to Fund Education & Transportation

"Massachusetts voters have approved a constitutional amendment to increase the tax rate on incomes over $1 million a year in order to generate more revenue for the Commonwealth's transportation and education programs.”